What is an IPID and what does this mean for you?

Posted in General on 10 September 2018

What is an IPID and what does this mean for you, the consumer?

On the 1st July 2018, The Insurance Distribution (Regulated activities & miscellaneous Amendments) order came in to force implementing the requirements in the EU’s Insurance Distribution Directive (IDD).

The IDD ensures all EU (including UK) insurance companies develop a fairer and more knowledgeable environment for customers with regards to the sale of general insurance products (not including life insurance products).

From 1st October 2018 the requirements imposed will apply, meaning that all consumers will now benefit from access to a simple, standardised ‘Insurance Product Information Document’ (IPID) which provides clear information on a particular general insurance product enabling consumers to make a well-informed decision before making a purchase.

The IPID is great news for consumers as it delivers an easy-to-read solution for those that have found comparing insurance products confusing and / or have struggled to understand industry jargon and terminology in the past, giving consumers a much better opportunity of buying an insurance product that meets their needs.

What does an IPID look like?

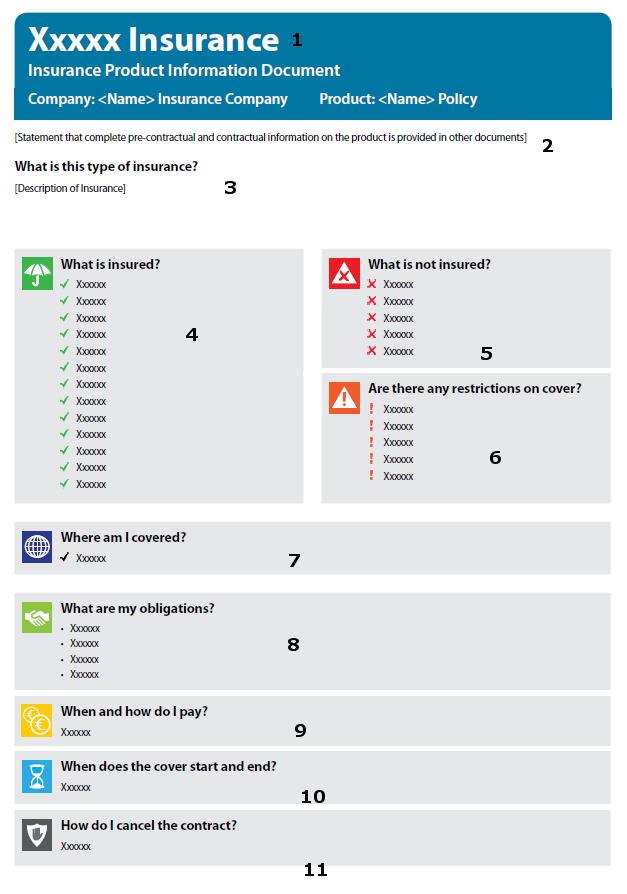

An example of an IPID is shown below (with Xxxx showing where the product information would be). As it is a standardised document, the information presented appears in the same section making it easier to compare different insurance products side-by-side.

An example of an IPID is shown below (with Xxxx showing where the product information would be). As it is a standardised document, the information presented appears in the same section making it easier to compare different insurance products side-by-side.

What will this IPID document tell me?

We’ve highlighted the distinct areas in the IPID template above so you can easily navigate your way around an IPID and the information included in the document.

(1) The first section of the IPID shows the company who designed the product, known as the ‘manufacturer’, the country in which the manufacturer is registered as well as its regulatory status and authorisation number immediately after the title – Insurance Product Information Document.

(2) Immediately beneath the above section should be a prominent statement outlining that the full and complete pre-contractual and contractual information about the General Insurance product is provided to the customer in other documents, such as the policy wording.

Please note: An IPID will not replace any contractual documentation that is provided with an insurance policy. As a consumer, you should read through all documentation to ensure all information is correct and the policy meets your needs.

(3) What is this type of insurance? –This section provides a brief outline on the type of insurance that the particular IPID relates to at the top of the document.

(4) What is insured? – Information on the main risks insured on this specific policy as well as the sums insured of each risk. Each piece of information listed in this section will be preceded by a green tick symbol. This section is really important to check and make-sure it covers all the elements you want protection for.

(5) What is not insured? – Information here relates to some of the key risks excluded from this insurance product. Each piece of information listed in this section will be preceded with a red X symbol. Again, it is important to check that anything you want cover for is not in this section as it will not be covered.

(6) Are there any restrictions on cover? – The information here details the main exclusions on this insurance product. Each piece of information listed in this section will be preceded with an orange exclamation mark symbol. Check that none of the restrictions affect you as these will not be covered.

(7) Where am I covered? – This section explains the geographical scope of the insurance product. Each piece of information listed in this section will be preceded with a blue tick symbol. This is particularly important for products such as travel insurance.

(8) What are my obligations? – This section identifies the obligations you have in terms of providing information to insurers and any ongoing obligations you must meet during the policy term.

(9) When and how do I pay? – This section sets out how you pay, the frequency of any payments and any other information / terms relating to premiums payment.

(10) When does the cover start and end? –Provides information relating to the term of the contact.

(11) How do I cancel the contract? – If you wish to cancel the policy, this section sets out the information on the means of terminating the contract.

The IPID has the potential to be a strong tool empowering consumers, helping them to gain more understanding of what is covered in their insurance policy. By understanding which products offer the best solution for their individual needs, consumers can start buying smart and not be put-off by the ‘so called’ small print in insurance policies.

The IPID should also help reduce the number of consumers who get caught out by policy terms that are not suitable for their individual circumstances, before they buy a policy rather than waiting until they have a claim which inevitably is declined.

From the 1st October 2018 all insurance policies from Voyager Insurance Services will be provided with an IPID. Get your travel insurance quote today from InsuraTrip here.

Other Related News Articles...

- Money Saving Tips for Your Wedding Day

- 4 European City Break Ideas for You to Consider This Autumn